Returning to my native island of Jersey in the 1980s after a long absence, I found the island transformed into an offshore finance centre. The combination of deregulation and technological change had opened up new markets. International banks and accountancy firms were queuing up for a slice of the action. The old town houses and merchant stores of Saint Helier were giving way to office blocks and car parks, and the island’s labour market was so overheated that unqualified school-leavers were being paid higher salaries than graduates on mainland Britain. Porsches, Jaguars and BMWs were the favourite cars on an island that measures nine miles by five.

I took a job in a trust and company administration business, where I had to follow instructions faxed daily from banks and law firms across the world. This was a world of smoke and mirrors, in which a Jersey registered company might be owned by a trust based in Luxembourg, with nominee trustees living in Switzerland. This procedure, involving secretive arrangements spanning three or more tax havens, is regarded as good practice in the tax planning industry, which goes to extraordinary lengths to inhibit investigation of what it does and on whose behalf.

One of my jobs was to set prices for goods and services traded within multinational companies in a way that minimised the amount of tax they had to pay. This process of ‘transfer mispricing’ has allowed plastic buckets to be imported to the US from the Czech Republic for a nominal price of $972.98 each, and rocket launchers exported from the US to Israel for $52.03 each. The resulting profits are allocated to a tax haven. Transfer mispricing is possible only within a multinational corporation, however. Companies without a global reach can achieve the same result by dealing through an agent in a tax haven, who pays part of his mark-up into the offshore account of the vendor or purchaser. I did a fair bit of this ‘reinvoicing’, too. A lot of my work related to trade with Asian or African countries. In some cases a special purpose vehicle – a company, trust, partnership or other legal entity set up for a particular purpose (often tax-related) during a transaction – would be used to make a one-off payment to an apparently unrelated third party for ‘consulting’ or agency services. Other companies were used for operating insider-trading scams. I was bored and angered in equal measure.

Any concerns about the origins of this money, much of which came from African states, were brushed aside. One Friday evening, before our habitual office binge-drinking session, my section supervisor, with characteristic bluntness, told me that she didn’t want to discuss these things and didn’t ‘give a shit about Africa anyway’. Her attitude was typical. Profitability was sky-high and no one made the connection between their actions and criminality and injustice elsewhere.

Appointed in 1987 as an economic adviser to the States of Jersey, I quickly saw that the banking and finance regulatory regime was, shall we say, light-handed. Local politicians lived in fear that scandal would harm the island’s international reputation and lead to intervention from the UK government. The preferred solution of leaving no stone turned lasted for a surprisingly long time, but when scandal finally came in 1996 – a currency trader called Robert Young, working in cahoots with Cantrade Bank, a Jersey subsidiary of the Swiss banking giant UBS, defrauded investors of $26 million – the Wall Street Journal concluded that Jersey was an offshore hazard ‘living off lax regulation and political interference’ and offering an invitation to money-laundering. Politicians responsible for financial regulation sat on the boards of the banks that they were appointed to regulate, and senior civil servants interpreted laws and regulations so as to further the personal interests of senior politicians and their cronies.

There have been several international initiatives aimed at tackling financial irregularity since the late 1990s, but the offshore economy has scarcely changed since I left Jersey in 1998. Shortly after taking power in 1997, Labour commissioned a former Treasury official, Andrew Edwards, to review the regulatory arrangements of the Crown Dependencies. Key recommendations from his report were simply ignored, however, and the fundamentals of secrecy remain largely unchanged. Offshore companies are now required to provide regulators with details of ultimate (or ‘beneficial’) ownership, but this information is not in the public domain and is obfuscated by a web of trusts and special purpose vehicles spread across several other jurisdictions. There remains no requirement to file annual financial statements. Offshore trusts are not required to provide any details about settlors or beneficiaries and have no requirement to file any financial records.

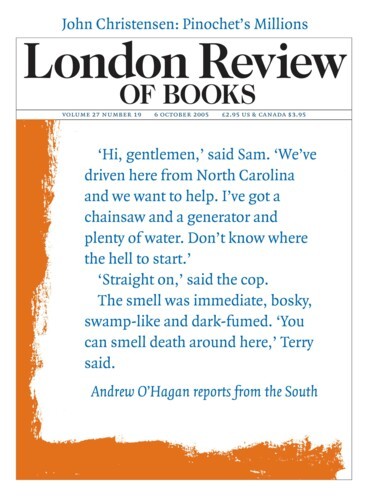

Banking compliance officers tell me, off the record, that due diligence procedures, even when ‘politically exposed persons’ (PEPs) are concerned, are largely box-ticking exercises. According to a US Senate report, Riggs Bank described one of its PEP clients as ‘a retired professional who achieved much success in his career and accumulated wealth during his lifetime for retirement in an orderly way’. The PEP in question was General Augusto Pinochet, who held between $6 and $8 million in offshore accounts established by Riggs, and is now being investigated for fraud and embezzlement.

Jersey became an offshore finance centre as a result of pressure from local law firms, some with strong political connections, and from the major City of London banks which had begun migrating offshore in greater numbers after Labour took power in 1964. Noticing that the Cayman Islands had successfully turned themselves into a tax haven, the States of Jersey decided to create a regulatory and judicial climate that was more attractive to the offshore finance industry. The boom of the 1980s and early 1990s saw the number of offshore tax havens increase from about 25 in the early 1970s to 72 by the end of 2004, as new laws were passed to encourage the use of offshore trusts, international business companies, tax-exempt special purpose vehicles and limited liability partnerships.

In the wake of the 1980s international debt crisis, banks shifted to targeting the world’s eight million or so high net-worth individuals (HNWIs, or hen-wees), believing they provided the most profitable growth area. In 1995 I was told that the industry target was to move the majority of hen-wee financial assets to offshore accounts and trusts within a decade. To judge from a recent study showing that $11.5 trillion of hen-wee assets are currently placed tax-free or minimally taxed offshore, the banks have made significant progress towards this goal. Were the returns on that sum taxed at an average rate of 30 per cent, the $255 billion additional revenue would cover the financing needs of the UN Millennium Project, which aims to double aid to poor countries by 2010.

In the 1980s much of the money coming into Jersey originated in the Middle East, sub-Saharan Africa and South-East Asia, but the fall of the Soviet Union led to a rapid growth of new business from Russia and Eastern Europe. In the early 1990s, an acquaintance with a small trust business in Saint Helier told me that he had signed up a Russian client with assets of more than $100 million. No one could really have believed that this wealth was obtained legitimately. Jersey has been a popular destination for Russian money, which is estimated to have flooded into Western banks at a rate of $20 to $30 billion annually since 1989. In 2002, the Institute for Information and Democratisation in Moscow concluded that the total outflow of corrupt and illicit funds, including losses due to customs corruption, ‘would effortlessly climb to $400-$500 billion’. Of this amount, probably $300 billion rests in Western and offshore accounts.

Microstates and small island economies, isolated and economically vulnerable, provide an ideal environment for the secretive world of offshore finance. Largely autonomous in domestic political, fiscal and judicial affairs, they act in a way that amounts to selling their sovereignty: in other words, they enact legislation favourable to those seeking to minimise both tax and regulation. They provide, as a result, an interface between the world of furtive money movements and the circuits of the global financial markets.

Many in the global justice movement think that increasing aid to poor countries will be ineffective unless it’s accompanied by measures to tackle the causes of poverty, which include the problems of capital flight and tax evasion. In Capitalism’s Achilles Heel, Raymond Baker probably errs on the conservative side in his estimate that the flows of dirty money from poorer countries into offshore accounts managed by Western banks are currently $500 billion annually. Corruption, which attracted so much media attention in the run-up to the G8 Gleneagles summit, accounts for only 10 per cent of this total.

Some of this money might be round-tripping: going to an offshore company, before being re-invested in the country of origin under the guise of foreign direct investment, thus attracting tax breaks and subsidies for the ‘beneficial’ owners of the investing company, who may well live in the country being invested in. Most flight capital, however, leaves its country of origin permanently, much of it destined for the financial and property markets of the major Western economies. The current global aid budget of $78 billion is insignificant alongside these massive wealth transfers in the opposite direction. It’s anyone’s guess how much dirty money has accumulated offshore, but at least $5 trillion has been shifted out of poorer countries to the West since the mid-1970s.

The outflows of domestic financial resources and the wholesale tax evasion that goes hand in hand with capital flight have had a devastating impact on developing and transitional economies. Deprived of domestically based private investment and tax revenues to fund public services, many governments have been forced into dependence on foreign direct investment and expensively serviced external debt. Both impose strict conditions on recipient states.

By and large, Western governments and multilateral agencies have downplayed concerns about dirty money except when drugs and terrorism are involved. James Wolfensohn provides the exception: during his presidency of the World Bank, he suggested that illicit financial dealings might partially account for the bank’s failure to achieve its goals. For the most part, however, the political and media focus has been on looting by despots and their cronies rather than on the workings of a global financial system that encourages and facilitates the movement of dirty money. Astonishingly, neither the World Bank nor the IMF has tried to investigate or quantify capital flight and tax evasion.

More than 50 per cent of the total holdings in cash and listed securities of rich individuals in Latin America is held offshore. Data for Africa are sparse, but the trend shows a huge increase in the rate of capital flight from sub-Saharan Africa in the 1980s, with about 30 per cent of the GDP of that region disappearing offshore in the second half of the 1990s. The situation in the Middle East and North Africa is even worse, which helps to explain the chronic unemployment and social tension throughout the region. Earlier this year, Tony Blair’s Commission for Africa proposed an additional $25 billion in aid to Africa by 2010, a sum dwarfed by the amounts coming out of Africa’s porous banking system.

Drawing on his time running businesses in Nigeria in the 1960s and 1970s, and his subsequent research into money laundering as a guest scholar at the Brookings Institution, Baker dispels any notion that offshore corporate lawlessness began with Enron, WorldCom and Parmalat. Things may have got worse since the 1980s, but Baker compellingly demonstrates the extent to which international trade and investment patterns have been constructed around elaborate tax evasion schemes in use since colonial times. With at least half of all world trade now being conducted on paper via tax havens, the opportunities for fraud and skulduggery are immense.

The ability of multinational businesses to structure their trade and investment flows through tax-haven subsidiaries provides them with a massive financial advantage over nationally based competitors. Local firms, regardless of whether they are technically more efficient or more innovative, find themselves competing on an uneven basis. In practice this market distortion favours the large business over the small, the international business over the national, and the long-established business over the start-up. The outcome has been that both in theory and in practice the use of tax havens by virtually every major global bank and multinational business has nullified David Ricardo’s doctrine of comparative advantage. Fundamentalist advocates of a no-holds-barred approach to free trade have persistently turned a blind eye to this problem. For those like Baker – and myself – who believe that free and fair trade can generate viable economic growth and spread its benefits across society, the blatant unwillingness of key players like the IMF, the World Bank and the UK government to tackle these global market failures says a lot about their real intentions.

Having suffered decades of venal dictatorship, Nigeria is a world-beater when it comes to dodgy financial practices. But the looting of the country’s resources, which reached its peak during Sani Abacha’s presidency in the 1990s, happened with the connivance of an extensive pinstripe infrastructure of banks, lawyers and accountants who provided the means for tens of billions to be shifted offshore. Some of these aiders and abetters came from Jersey. They would have been aware of the source of the funds and must have profited magnificently from handling this stolen property.

Challenging the view that financial scandals and tax dodging are isolated cases in an otherwise robust system, Capitalism’s Achilles Heel shows how these ‘negative externalities’, as economists describe them, have generated a spirit of lawlessness that threatens the integrity of the market system and the finance industry as a whole. A British tax accountant was quoted in the Guardian last year as saying that ‘no matter what legislation is in place, the accountants and lawyers will find a way around it. Rules are rules, but rules are meant to be broken.’ The victims of this predatory tax-dodging culture include the poorest and most vulnerable people on the planet.

Much of the growth of the offshore economy has been driven by British lawyers and accountants. As early as the 1920s, they pioneered the use of trusts, shell companies, transfer mispricing, re-invoicing, dummy wire transfers – which give the impression a company is operating out of a tax haven rather than its actual location – and special purpose vehicles. Dodging tax was the prime motive, but inevitably, as Baker explains, laundering narco-dollars and paying off corrupt officials involve the same processes as tax evasion.

There’s little doubt that secrecy drives the offshore economy. This was acknowledged by members of the Swiss Banking Association when, in a rearguard action in the wake of the Nazi gold scandal, they took out half-page ads in various broadsheets to propose, unconvincingly, that ‘secrecy is as vital as the air we breathe.’ But secrecy has a cost. In most countries of the South, there is general public resentment that the proceeds from national resources have been expropriated and exported wholesale to Western bank accounts. The corrosive outcome of poor education, failing infrastructure and entrenched unemployment is widespread discontent and an increase in poverty and crime. ‘Crime flourishes in weak states, those that have millions in poverty, often accompanied with vast inequality,’ Baker writes. ‘Poverty fosters crime, and crime is in business with terrorism. Terrorism feeds off crime and poverty. It is the middle link in this chain – crime – that unites poverty and terrorism, a linkage that needs to be well understood.’

With no concern for justice and equity, fundamentalist utilitarian theories have been deployed to justify expropriation and lawlessness in the name of efficiency and freedom. The result has been an economic order that cannot and does not meet the world’s welfare and security needs.

Send Letters To:

The Editor

London Review of Books,

28 Little Russell Street

London, WC1A 2HN

letters@lrb.co.uk

Please include name, address, and a telephone number.