This book found me in the midst of a prolonged, if not necessarily profound, contemplation of the market for insurance and reinsurance known as Lloyd’s of London. What interests me about Lloyd’s is not the misfortunes it suffered in the late Eighties or its spectacular losses, the evident incompetence of its professionals and functionaries or its silly building, but the conduct of the passive investors in the market known as the External Names, about thirty thousand families of the English and Scots high middle class.

These men and women, presented with losses on underwriting for the years 1988, 1989, 1990 and 1991 many times greater than their investment and even their net worth, have responded in unusual fashion. They have rebelled and many seem bent, Samson-like, on bringing the Lime Street temple down about their ears. This seems to me a novelty in the glorious annals of British commerce. For Lloyd’s, with its folklore and its barbaric mixture of caution and dizzying risk, is an institution peculiar to this country and one that is incomprehensible to foreign nations, even those with strong commercial traditions; and the refusal of the Eighties’ Names to take their commercial knocks seems to me a break in British commercial culture. Is this the end of British commerce, which – abetted by a talent for warfare, diplomacy, public administration and espionage – made this country a world power?

In this meditation I found David Kynaston a sympathetic companion. Not that he has anything of interest to say about Lloyd’s: this oversight is one of my many frustrations with his excellent book. But he is deeply interested in the nature of the City, in what made it successful then and now, why some businesses are still good two hundred years after their founding and others have fallen to bits or withered away. His taste in quotation is refined, and I found some of my answers.

The first comes, fittingly enough, from Nathan Rothschild, perhaps the greatest figure ever to adorn the international capital markets, greater even than J.P. Morgan and Michael Milken in their primes. At a dinner in 1834, someone expressed the hope that the Rothschild children were not too attached to money and business: the rentier cast of mind had already set by this period. Nathan answered:

I wish them to give mind, and soul, and heart, and body, and everything to business; that is the way to be happy. It requires a great deal of boldness, and a great deal of caution, to make a great fortune; and when you have got it, it requires ten times as much wit to keep it.

These two sentences should be engraved above the portals of every ruined golf club and burned manor house in Southern England. For how could these Names believe that they could protect their inheritance by consigning it to some florid Members’ Agent at Lloyd’s, reeking of kümmel and pomade, simply because he spoke proper and had been to the same school (though sacked, of course, for failing Trials)?

The second answer comes from Joshua Bates, the Bostonian who became a partner of Barings in 1828, and ran the place for the next thirty-five years until control reverted to the family, the firm tied up its capital in public works in the Argentine and had to be fished out of a Buenos Aires sewer. In August 1856, Bates made a day excursion to Walton-on-Thames to view a villa a fellow partner was thinking of buying; and his commercial soul revolted at the commitment of £15,000 in money: ‘Who ever heard of a man laying out his capital on a country house?’ The peculiar habit many External Names have of locking up their wealth in illiquid assets of purely social yield – manors, farms, pictures and so on – and then leveraging them at Lloyd’s for cash would have seemed to Bates foolish, which it is; but to treat this highly speculative investment as if it were gilt-edged, as if it were ‘the sweet simplicity of the 3 per cents’, is beyond foolish. But I guess the English were always gamblers.

The third answer comes from Hawthorne, by some distance my favourite of all American writers. In late 1857, in his role as United States Consul at Liverpool, Hawthorne dined with the partners of the wholesale silk merchants Bennoch, Twentyman and Rigg which had just failed with liabilities of somewhat over £250,000. He wrote: ‘I was touched by nothing more than by their sorrowful patience, without any fierceness against Providence or against mankind, or disposition to find fault with anything but their own imprudence; and there was a simple dignity, too, in their not assuming the aspect of stoicism.’ I have heard such sentiments only from two of the many, many burned Names I’ve met and interviewed.

Lloyd’s is not the only ticking bomb in the City, nor even the most perilous. Others, in no particular order, are these: will speculation in derivative financial instruments engulf their mother markets, leading to bank failure, depression, war etc? Will new management at Barclays Bank reform that house and, through example, the other clearing banks, which really are now mere burdens on the earth? And will the Bank of England, which made such a gorgeous pig’s ear of monetary control and banking supervision in the late Eighties, recover that indefinable authority that has made it a force for order in the City for three hundred years?

These questions are of capital importance. The City is the source of our marginal prosperity and has been since the late 19th century. As Kynaston says somewhere, in terms more restrained than these, its men and women earn the extra foreign exchange that pays for those pissy foreign luxuries to which we are so addicted; and those in the west end of town, who affect to despise or condemn the City, should first forgo their mobile phones, their Mitsubishi jeeps, their holidays in Barbados, their sun-dried tomatoes.

The book covers, rather intermittently, the period from Waterloo to the Barings crisis of 1890 and has for its subject the transformation of the Square Mile from a centre of the wholesale merchant trade, with a strong foreign outlook, which also raised money for the government to go to war, to a market that financed almost all worldwide trade and yet had capital to spare to lend to foreign governments, build railroads and other public works at home and abroad, and lastly, and very reluctantly, supply long-term finance to British manufacturing industry. On this last point, Kynaston shows much better and more concisely than all the vast ‘decline of Britain’ literature why the City and the men from the Midlands get on so badly and why the debate conducted under the Stichwort ‘short-termism’ is so stale and tedious.

It is obviously a thrilling story, and Kynaston has an excellent technique. He approaches his subject through the medium of old-fashioned narrative history (men doing things), which works because it all happened so recently and within such tight geographical limits; as it works, for example, in Thucydides’ account of the siege of Plataea. Kynaston also has an eye for architecture and street topography and how people live in great cities, and he eventually provides a worthy set-piece climax where we seem to know every inch of pavement over which Lord Revelstoke of Barings hurries in tears.

Above the masses of clerks and fraudsters and Quakers and spivs, three heroes stand out and preside over Kynaston’s account. The first is Nathan Mayer Rothschild, who on page five irrupts into the narrative, which is still reverberating five hundred pages later. At a dinner in 1834, the brewer Sir Thomas Buxton asked him for his life story: ‘I said to my father, “I will go to England.” I could speak nothing but German. The nearer I got to England, the cheaper goods were. As soon as I got to Manchester, I laid out all my money, things were so cheap, and I made good profit.’ The journey he describes occurred in 1799, and two hundred years later one still senses his intelligence, elation and straightness. The first illustration in the book, a caricature done in October 1817, shows a man in a stove-pipe hat with a big belly and florid lips. He stands, one hand in his pocket, the other holding a piece of paper with a pudgy thumb. The reproduction is poor so one can’t read the writing on the paper but it is presumably a foreign bill of exchange; and the way he holds it, without invitation or anxiety, there before his favourite pillar on ’Change, distills his character for me. There is some anti-semitic caricature in the face, but what was mere anti-semitism to such a person?

The second hero is Bates, who shared with Nathan an unsleeping interest in business, to David Kynaston’s great approval. Travelling to Dover by train on 15 July 1847, just after the liberalisation of the grain trade, he wrote to Tom Baring: ‘From London to this place I did not see a patch that was defective in wheat fields.’ A managing director of Drexel Burnham Lambert once told me that on Saturdays Milken used to take his young family to supermarkets in the San Fernando Valley and peer rudely into trolleys at the check-out, to see what people were buying.

The third of Kynaston’s heroes is William Lidderdale, a Scotsman and partner in the Liverpool merchants Rathbone Bros, who rose to be Governor of the Bank of England and save the toffs in 1890: for this admirable man, Kynaston has a special sympathy. That these men were, respectively, a German Jew, a New Englander and a Scot, is also important to Kynaston, for he seems to believe that the City prospers only in so far as it is open to outside influence and blood. I am sure he is right and that the next saviours of British commerce will come from the greatest pool of unexploited intelligence in British society: females.

Kynaston’s great strength is his sources: not merely the archives at N.M. Rothschild – which includes Charlotte de Rothschild’s marvellous letters to her children – at Barings and at Rathbones; but also the records of the Stock Exchange, where he captures all the boyish innocence of the floor, which survived intact until face-to-face trading was foolishly abolished in the Eighties. I was happy to learn that the Varna and Rustchuk Railway 3 per cent obligations were traded in the 1880s as ‘Bulgarian Atrocities’. All these items any competent journalist could have read and distilled, but Kynaston also has a feel for literature: his range includes the extraordinary diary of Guendolen Morris (which, on the evidence of the quotation here, really should be published), as well as Grote, Hawthorne, Melville, Poe at his most divine, Trollope, Galsworthy and Dickens, and those literary men who grew up in City families – Ruskin, Morris, Hopkins – and fled in horror. And this shows good judgment for, in the end, we don’t really give a toss about the Moscow-St Petersburg Railway, that the loan was at 4½ and 93, was oversubscribed 25 times and that Barings made £105,000 out of it; only that it was built in time for Vronsky to catch his first glimpse of Anna Karenina. For though businesses can survive for centuries, they must be refashioned by each generation; but art is a language in which the generations can converse.

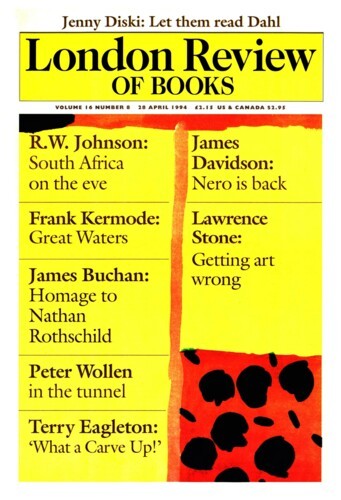

Having praised this book so incontinently, I must now record my frustrations with it, which are numerous. First, Kynaston gives us all the 19th-century booms and busts, which came round, then as now, in a rhythm of about ten years; but we gain no sense of the long-run trend in the prices of goods and money. Second, the City was clearly transformed in the early years of the century by the creation of a pool of short-term liquidity: this was the discount market, a peculiarly ramshackle piece of British genius which is very hard to understand even after long study – and readers get little help from Kynaston. Third, Kynaston’s City is somewhat isolated from Victorian life. Though the book carries on its cover the genre painting. Dividend Day at the Bank of England, we learn little of the creation of a British rentier class nourished, first on the income and security of the British government bonds known as Consols, and then on railway obligations. Kynaston states that, between 1850 and 1870, ‘a fully fledged rentier class was born.’ This is wrong, historically and ornithologically. By ignoring the rentiers and their permanent conflict with the producing classes, Kynaston fails to make interesting the debate over Bimetallism and Goschen’s reduction of the coupon on Consols at the end of his period.

Fourth, he doesn’t really understand the Bank of England, but then I don’t suppose anybody does: it is as hard to write sense about the Bank as about the Monarchy. Fifth, he is conscientious in describing relations between the City and the West End, but fails us when we need to know more about the influence of City interests on Imperial policy. We are given a very external and shop-worn account of the events leading up to the occupation of Egypt in 1882. It would have been more fun to look at somewhere new, such as Iran, where the activities of City men in connivance with a weakling Qajar Shah created a hatred of this country that still burns hotly today. Fifth, though he quotes Galsworthy, he ignores Karl Marx, whose moral clash with the City was somewhat more productive: I wonder if he’ll ignore another great and unfashionable economic journalist, Keynes, in Volume II. Finally, though the book is very well written, Kynaston has a fondness for last year’s slang. I imagine he introduced these sentences in the hope of attracting readers in the City; but he is wasting his time. I never met anybody in the City who’d read a book, and would not do business with a person who engaged in such an unremunerative pastime.

Send Letters To:

The Editor

London Review of Books,

28 Little Russell Street

London, WC1A 2HN

letters@lrb.co.uk

Please include name, address, and a telephone number.